Fiscalisation costs money!

Fiscalisation brings no advantage!

2021 has been a year of many changes for companies in Germany. A major one was the entry into force of the Act on Protection against Manipulation of Digital Basic Records and the associated ordinance of the Cash Security Ordinance, or KassenSichV for short.  Internationally, such legal regulations are referred to as "fiscalisation". The aim of such acts is the desire of the tax authorities to prevent trickery in connection with cash registers.

Internationally, such legal regulations are referred to as "fiscalisation". The aim of such acts is the desire of the tax authorities to prevent trickery in connection with cash registers.

If, for example, a software company wants to make its electronic recording system (e.g. cash register software) available to the customers, it is forced to comply with existing fiscalisation laws. Otherwise there is a risk of exclusion from the market. In Germany, even the advertising of a POS system that is not connected to a certified technical security device (TSE) is penalised. Since all market participants have to comply with the law, implementing them does not bring on its own any market or competitive advantage. The rule is simple: I have to comply, otherwise I won't play!

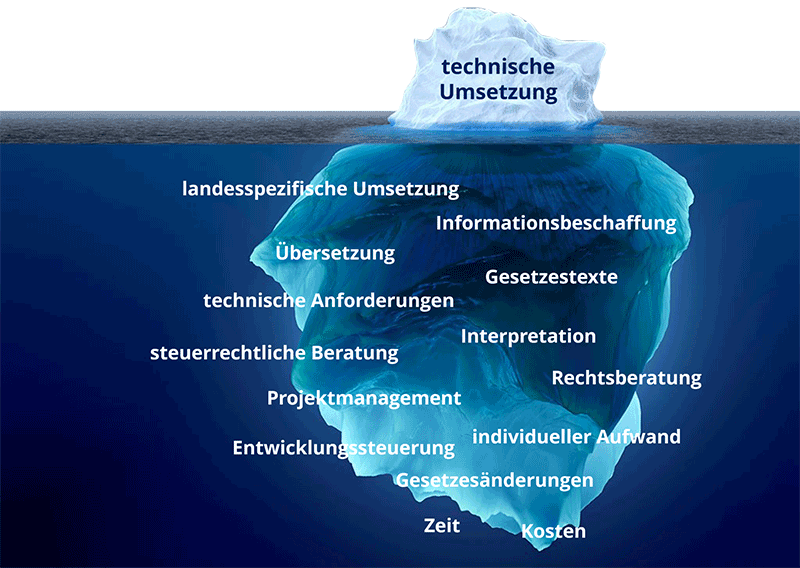

Companies that have implemented the KassenSichV or other fiscal solutions know that a fiscalisation project means several months of work. Internal resources are suddenly tied up with activities that do not fit into the core competencies of a cash register manufacturer. You have to deal with legal documentation, often you even have to go through translation process, which often leaves to much room for interpretation, you collaborate with tax officials and consultants, which also generates external costs, and so on.

Once the project is implemented, there is another hurdle: companies that operate internationally know that fiscal laws change from time to time. Gaps are closed by the tax authorities, processes are adapted or a decision to switch to newer, more modern technology is made. Both during the initial implementation and subsequently, costs and resources are spent here that could be invested more sensibly, for example in a customer project or the further development of one's own software.

Concentration on the core competences

In my first economics lecture many, many years ago, the lecturer gave an example of the 5th rule of economics, "Everyone can be better off through trade". It was about an arable farmer who had to invest more man-hours for a pound of meat but less for a pound of potatoes compared to his neighbour, the cattle farmer. The core message is often forgotten in business life: "Concentrate on what you do best and buy what others can offer for less cost (because it is what they specialise at)!". Especially in the software industry, I often experience the approach of wanting to do everything yourself. A partnership with companies that have focused on solving a specific problem can sometimes make things easier.

Archiving cash register data

The retention and archiving of tax-relevant documents has always been anchored in state finance laws. Whereas in past times real business books had to be kept, the change in the area of (recording) cash register systems has moved from the double receipt roll to the digital form.

The retention of business records is part of "ordinary bookkeeping" or proper accounting. This loose set of rules consisting of partly written down, partly lived business practices was summarised in Germany by the Federal Ministry of Finance (BMF) in the letter "Grundsätze zur ordnungsmäßigen Führung und Aufbewahrung von Büchern, Aufzeichnungen und Unterlagen in elektronischer Form sowie zum Datenzugriff" - the GoBD. The GoBD thus shows what the BMF understands by proper bookkeeping.

Backup and archiving are neglected time and again in practice. Hand on heart, which of you dear readers have really saved all your private and business documents, records, photos, etc. in such a way that they are protected against loss or a possible attack? A loss of private e-mails may be unpleasant, but in most cases it can be tolerated.

In business, the situation is somewhat different. Here, the failure to present documents that are used for taxation purposes may result in a financial offence and, in the worst case, criminal proceedings.

This makes the safekeeping of business documents a lot more important. The principles set out by the GoBD in this context are:

- traceability and verifiability

- completeness

- accuracy

- timely bookings and records

- orderliness

- immutability

should be sufficiently known. The term "audit security" is also often used here. This generally refers to (tamper) proof systems that can store data unchangeably over a longer period of time. This is ensured with both technical and organisational methods and measures. In order for an archive to actually be considered audit-proof, it must be possible to prove that the data has really been stored in an unchangeable manner for the entire duration of storage.

In my opinion, business documents such as electronic records should not only be stored securely because regulations such as the GoBD require it. This should be done simply to protect one's own interests. Which company in your opinion takes longer to carry out a cash audit, a company that can present all documents quickly and easily or a company with the electronic equivalent of "paperwork"?

Short profile guest author Harald Krondorfer

Harald Krondorfer has been working in the field of fiscalisation since 2014 and is the managing director of RetailForce Software GmbH. RetailForce is a solution provider in the areas of fiscalisation, archiving and digital receipts.

Did you like our article? Then feel free to share it.